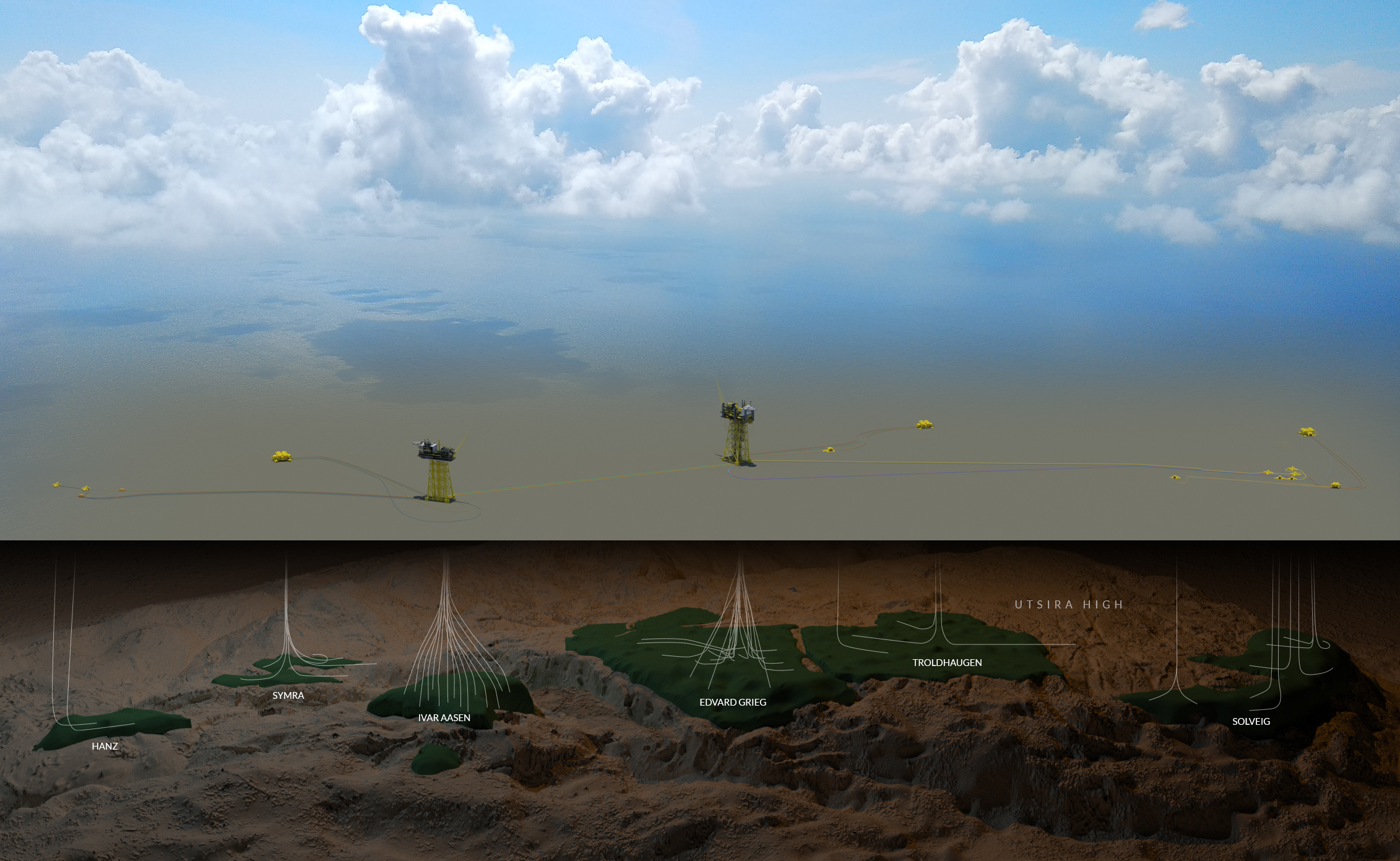

TechnipFMC is awarded a contract for three field developments at the Utsira High in the North Sea. The contract comprises engineering, procurement, construction and installation of subsea production systems, controls, pipelines, and umbilicals. The three fields will be tied back to the Edvard Grieg and Ivar Aasen production platforms.

The team from TecnipFMC has for the past two years been conducting the FEED phase for the Symra, Solveig phase 2 and Troldhaugen projects. So, we’re delighted to be able to continue the good cooperation through the construction and installation phase, said Stine Kongshaug McIntosh, VP Projects Execution for Edvard Grieg and Ivar Aasen in Aker BP.

The three developments will be bundled into one joint project in the execution phase, named Utsira High Project. Utsira High Project will develop recoverable resources of 124 million barrels oil equivalent. Drilling will commence in third quarter 2025, while production start-up is scheduled for first quarter 2026 for Solveig and Troldhaugen, and first quarter 2027 for Symra.

Solveig Phase 2 and Troldhaugen will be tied back to Edvard Grieg, while Symra will be tied back to Ivar Aasen for a partial processing before final processing at the Edvard Grieg platform.

Edvard Grieg was designed and built as a field centre with the capacity to be a host platform for new fields in the vicinity. Edvard Grieg is also the host platform for the Solveig field (phase 1) and for test production from the Troldhaugen discovery. The Ivar Aasen field was a coordinated development with the Edvard Grieg field. Oil and gas from Ivar Aasen are transported to the Edvard Grieg platform for final processing.

All producing fields on the Utsira High will be operated with electrical power from shore. Hence the CO2 emissions from the production phase will be very low.

Significant ripple effects

It is expected that more than 60 per cent of value creation from the Utsira High Project will be in Norway, and secure around 10.000 FTE’s.

-This represents a relative high share of domestic content for a development project on the Norwegian Continental Shelf, said Stine Kongshaug McIntosh.

Fabrication and testing will take place in Bergen, Stavanger, Kongsberg, Horten and Orkanger, among other locations. Engineering work will be performed out of Lysaker and Kongsberg.

Production licenses and partnerships

Symra – PL 167, 167B, 167C:

Aker BP 50 percent (operator), Equinor 30 percent, Sval Energi 20 percent

Solveig Phase 2 – PL 359:

Aker BP 65 percent (operator), OMV 20 percent, Wintershall Dea 15 percent

Troldhaugen – PL 338C:

Aker BP 80 percent (operator), OMV 20 percent