The Johan Sverdrup partnership has decided to proceed with (DG2) Phase 2 of the Johan Sverdrup development.

Phase 1 of Johan Sverdrup is under development, with first oil scheduled for late 2019. The partners will now proceed with maturing Phase 2 for the investment decision and submission of the plan for development and operation (PDO) in the second half of 2018. Phase 2 is scheduled to come on stream in 2022.

Phase 1 of Johan Sverdrup is under development, with first oil scheduled for late 2019. The partners will now proceed with maturing Phase 2 for the investment decision and submission of the plan for development and operation (PDO) in the second half of 2018. Phase 2 is scheduled to come on stream in 2022.

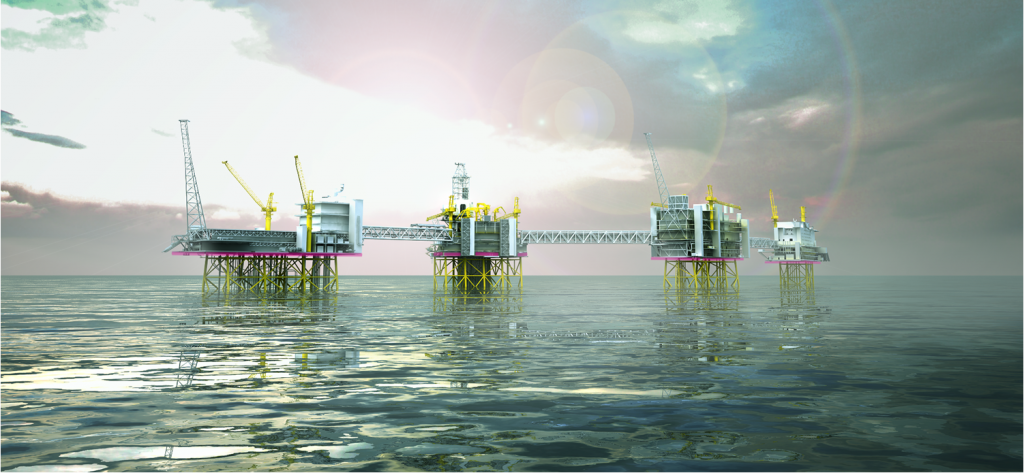

Phase 1 of the development establishes a field centre consisting of four platforms on the field. Phase 2 builds on this infrastructure, adding another processing platform to the field centre. Overall this will result in a processing capacity of 660 000 barrels of oil per day.

Capital expenditures for Phase 2 are now estimated at between NOK 40 – 55 billion (NOK billion nominal, fixed currency and excluding IOR), halving the estimate since the PDO was submitted for Phase 1 of Johan Sverdrup.

For further information and contract awards please refer to the Statoil press release dated 21 March 2017.

The Johan Sverdrup partnership:

- Statoil (operator): 40.0267%

- Lundin Norway: 22.6%

- Petoro: 17.36%

- Aker BP: 11.5733%

- Maersk Oil: 8.44%

Facts about Johan Sverdrup:

Johan Sverdrup Phase 1:

- Includes the development of four platforms, three subsea installations for water injection, power from shore, export pipeline for oil (Mongstad) and gas (Kårstø).

- Under development. Approx. 40 % of the development is completed.

- More than NOK 60 billion worth of contracts awarded. More than 70 % of the suppliers with a Norwegian billing address.

- CAPEX estimate: NOK 97 billion.

- Break-even Phase 1: Below USD 20 per barrel.

- Production start: late 2019.

Johan Sverdrup Phase 2:

- Includes development of another processing platform for the field centre + the Avaldsnes, Kvitsøy and Geitungen satellite areas, in addition to power from shore to the Utsira High in 2022.

- Made the DG2 decision to proceed with the development

- Investment decision (DG3) and submission of the plan for development and operation: Second half of 2018.

- Investment estimate: NOK 40 – 55 billion.

- Break-even price: Below USD 30 per barrel.

- Production start: 2022.

Full field (Phase 1 + Phase 2):

- Includes both Phase 1 and Phase 2 of the Johan Sverdrup development.

- Resource estimate: 2.0 – 3.0 billion barrels of oil equivalent.

- Break-even price: Below USD 25 per barrel.