Development of the NOAKA area

Following the recently announced changes to the Norwegian petroleum tax system, Aker BP and Equinor have entered into an agreement in principle on commercial terms for a coordinated development of the licenses Krafla, Fulla and North of Alvheim (NOAKA) on the Norwegian Continental Shelf and have started preparations for submitting Plans for Development and Operation (PDO) in 2022.

The development of the area will have significant effects on the Norwegian supply industry. Total investments are expected to be more than NOK 50 billion.

Employment

The employment effect is estimated to 50,000 FTEs in the development phase, including ripple effects. In the preparation phase before the Plans for Development and Operation are submitted in 2022, the employment effect is estimated to approximately 2,000 FTEs. The preparations will start immediately, and contracts for concept studies are expected to be awarded shortly.

Karl Johnny Hersvik, CEO of Aker BP comments:

“The recently announced tax changes give strong incentives to develop the NOAKA area and through this agreement we can mature all the resources in the area towards an investment decision. This will potentially unlock more than 300 mmboe of oil and gas resources for Aker BP, and hence significantly contribute to our growth. This is important to us, and perhaps even more important for the supply industry and the Norwegian society.”

Field development

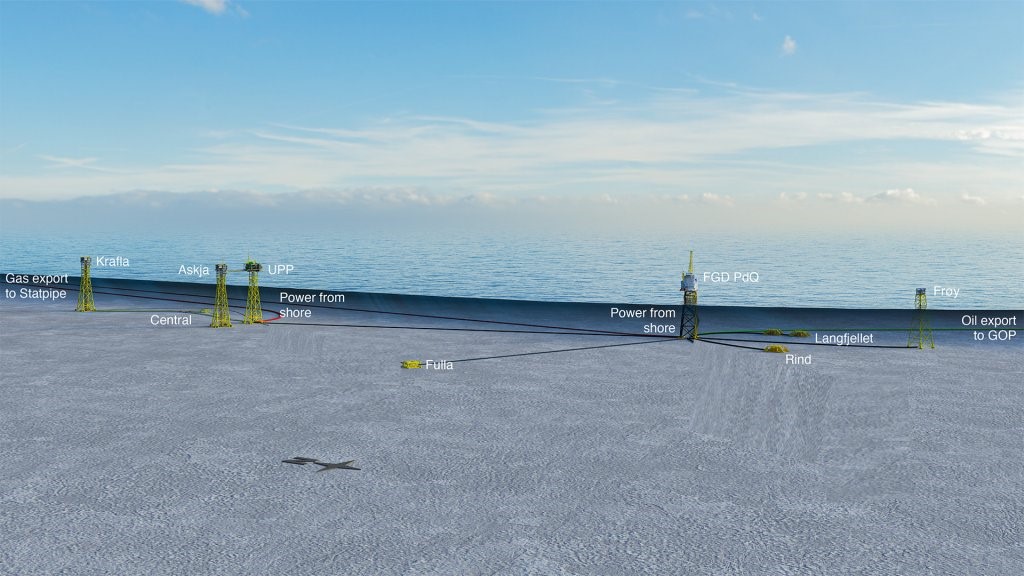

The NOAKA area is located between Oseberg and Alvheim in the Norwegian North Sea. The area holds several oil and gas discoveries with gross recoverable resources estimated at more than 500 million barrels of oil equivalents, with further exploration and appraisal potential.

This makes NOAKA one of the largest remaining field development opportunities on the Norwegian Continental Shelf. The partners in the licences are Aker BP ASA, Equinor ASA and LOTOS Exploration and Production Norge AS.

The plans for the area consists of a processing platform in the South operated by Aker BP, an unmanned processing platform in the North operated by Equinor and several satellite platforms and tiebacks to cover the various discoveries.

Synergies

The purpose of the commercial terms is to secure an optimal and fair allocation of cost and production between the discoveries and to align incentives and hence ensure good integration and synergies across facilities and licenses.

The concept will be further optimised prior to submitting the PDO, and the partnership has an ambition to further reduce cost with an integrated contract strategy.

Powered from shore

The partners share the ambition to develop NOAKA with a minimal carbon footprint. State-of-the-art technological solutions will be used to ensure high efficiency and low emissions.

The field will be powered from shore and an extensive use of digital solutions is expected both in the development and operations phase.

The company will also evaluate the opportunity of combining this with offshore wind, which could potentially enable power to be exported back to shore in the future.

Investor contacts

Kjetil Bakken, VP Investor Relations, tel.: +47 91 889 889

Lars Mattis Hanssen, Senior IR Professional, tel.: +47 99 459 460

Media contacts

Tore Langballe, VP Communications, tel.: +47 907 77 841

Ole-Johan Faret, Press Spokesman, tel.: +47 402 24 217

Disclaimer

The commercial agreement described in this statement is subject to approval by relevant parties. The final investment decision for a development of the NOAKA area has not yet been concluded.

About Aker BP

Aker BP is a fully-fledged E&P company with exploration, development, and production activities on the Norwegian Continental Shelf. Aker BP is the operator of Alvheim, Ivar Aasen, Skarv, Valhall, Hod, Ula and Tambar. The company is also a partner in the Johan Sverdrup field. Aker BP is headquartered at Fornebu, Norway, and is listed on the Oslo Stock Exchange under the ticker AKERBP. More about Aker BP at www.akerbp.com.

This information is subject to disclosure requirements pursuant to section 5-12 of the Norwegian Securities Trading Act.