Development costs goes down on Johan Sverdrup

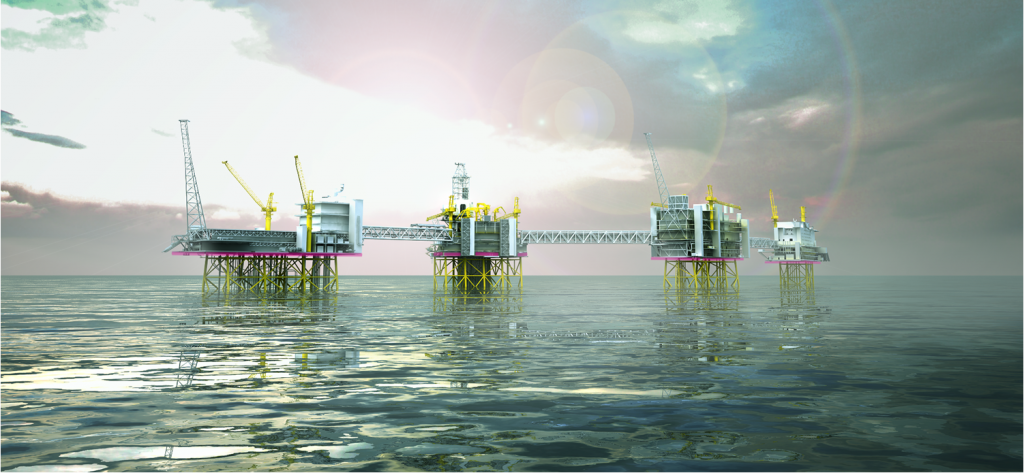

Aker BP ASA («Aker BP”) along with the partners in the Johan Sverdrup, reports updated key figures for the Johan Sverdrup project.

The investment costs on the Johan Sverdrup development continues to show a positive trend. Statoil, as Operator for the field, reports updated key figures at their Capital Markets Day today.

Current estimates for the first phase is estimated to NOK 97 billion (Capex numbers in nominal terms based on project currency), from 123 billion kroner since the Plan for Development and Operation (PDO). Current break-even is now below 20 dollars per barrel for Phase 1, below 30 dollars per barrel for Phase 2, and below 25 dollars per barrel for the full field development project.

The estimate for the full-field investment has been improved from NOK 208 billion nominal in 2015 to a current estimate of NOK 137-152 billion nominal.

Since the PDO for the first phase was submitted, the range of the Operator’s full-field resource estimate has improved from 1.7-3.0 to 2.0-3.0 billion barrels of oil equivalents. This update does not result in a revision of Aker BP’s reserves in Johan Sverdrup, estimated to be 300 million barrels of oil equivalents (P50) in 2016.

Partners in Johan Sverdrup:

Statoil 40,0267% (operator)

Lundin Norway 22,6%

Petoro 17,36%

Aker BP 11,5733%

Maersk Oil 8,44%