Aker BP projects referenced in the 2026 national budget

The Norwegian Government’s proposal for the 2026 national budget includes updated investment estimates for Aker BP’s development projects, expressed in Norwegian kroner (NOK). The figures are consistent with those reported by Aker BP in July, now converted from US dollars to NOK.

Aker BP’s portfolio of ongoing development projects now totals NOK 288 billion in gross investments, an increase of NOK 75 billion compared to the original estimates. Approximately two-thirds of this increase is attributed to currency fluctuations and value-enhancing changes, including the integration of East Frigg into the Yggdrasil development.

“The investment estimates reflected in the national budget were communicated to the market during our second-quarter presentation in July this year. Aker BP reports in US dollars, and the total increase in investment estimates across ongoing projects is around 6 percent. We maintain strong control over both costs and progress,” says Karl Johnny Hersvik, CEO of Aker BP.

Hersvik adds that both production outlook and project resilience have been significantly strengthened since the submission of the Plans for Development and Operation (PDOs) in 2022.

“Through the integration of East Frigg and the strengthening of the US dollar, estimated revenues from the Yggdrasil area alone are projected to be more than NOK 100 billion higher than previously expected,” says Hersvik.

Drivers behind the investment increase

The increase in investment estimates since the PDO approvals is primarily driven by three factors:

Currency effects

More than one-third of the increase is due to the weakening of the Norwegian krone against the US dollar since the projects were initially estimated. While this raises the cost profile when measured in NOK, it has limited impact on Aker BP’s financial reporting, which is conducted in USD. A stronger dollar also contributes to higher revenues in NOK, as oil revenues are predominantly USD-denominated – thereby supporting project profitability.

Value-enhancing changes

Approximately one-quarter of the increase is linked to measures that improve project economics. A key example is the East Frigg discovery in the Yggdrasil area in 2023. The field is being developed as a subsea tie-back and is now fully integrated into the Yggdrasil project, increasing the resource base by around 10 percent.

Inflation and increased activity

The remaining portion of the increase is due to higher-than-expected inflation, as well as increased use of input factors and labour across the development projects.

Project updates

Yggdrasil

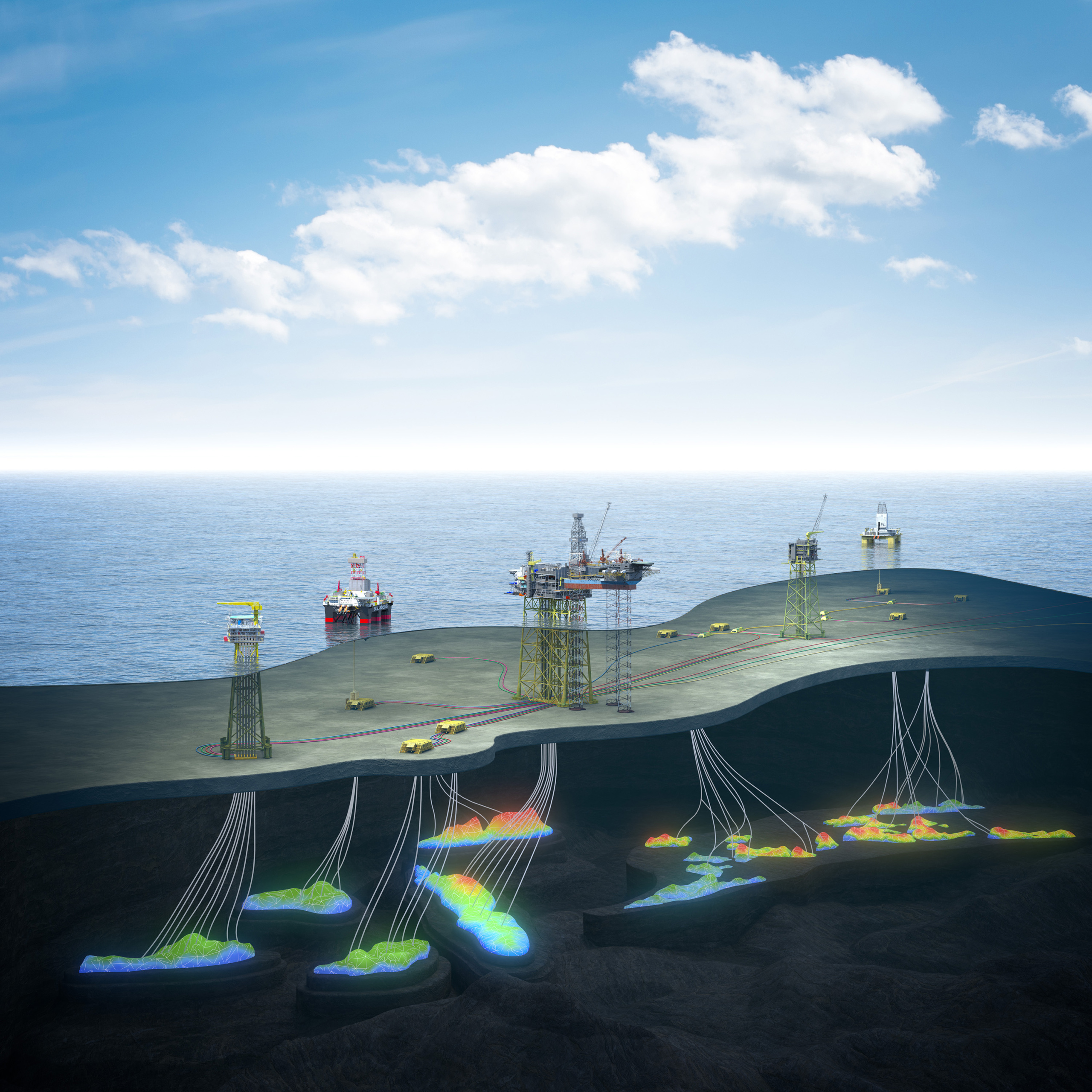

The Yggdrasil development includes the Hugin, Munin and Fulla fields. In 2025, assembly of platform modules is underway at yards and suppliers both in Norway and internationally, alongside installation of subsea infrastructure and drilling operations. The integration of the East Frigg discovery, confirmed in 2023, has increased the resource base of the project by approximately 10 percent.

The investment estimate has increased by NOK 49 billion since the PDO approval, totalling NOK 177.6 billion. Around 70 percent of this increase is due to currency effects and value-enhancing changes, including the integration of East Frigg and optimisation of well plans. The remainder is driven by market conditions, higher-than-expected inflation, and measures to manage a tight supplier market.

The project is on track, with production start-up expected in 2027.

Valhall PWP–Fenris

The Valhall PWP–Fenris project includes a new production and wellhead platform at Valhall, as well as a subsea tie-back from the Fenris field. In 2025, construction work is underway at several yards. The jacket and bridge for Valhall PWP were installed in summer 2025, and drilling operations have commenced. Topsides for Fenris and Valhall PWP are being prepared for installation in 2026.

The investment estimate has increased by approximately NOK 20 billion since the PDO approval, totalling NOK 75.9 billion. Approximately 55 percent of the increase is due to currency effects and value-enhancing changes. The remainder is driven by market conditions, inflation, capacity expansions, and the need to build at more locations than originally planned.

The project is on track, with production start-up expected in 2027.

Skarv Satellite Project (Alve Nord, Idun Nord, Ørn)

The development of Alve North, Idun North and Ørn is part of the Skarv Satellite Project, with tie-in to existing infrastructure at the Skarv field.

The investment estimate has increased by approximately NOK 4.6 billion since the PDO approval, totalling NOK 23.2 billion. Around 65 percent of this increase is due to currency effects and value-enhancing changes, particularly measures that improve expected recovery and enable earlier start-up. Other contributing factors include increased activity levels, adjustments in project execution, market conditions and inflation.

The project is on track, with production start-up expected in 2027.