Aker BP and partners make gold out of the Gråsel discovery

Operator Aker BP and the Skarv partners (Equinor, Wintershall Dea and PGNiG) have decided to develop the Gråsel discovery in 2021.

The partners approved the final investment decision (DG3) for the Gråsel development on 17 December.

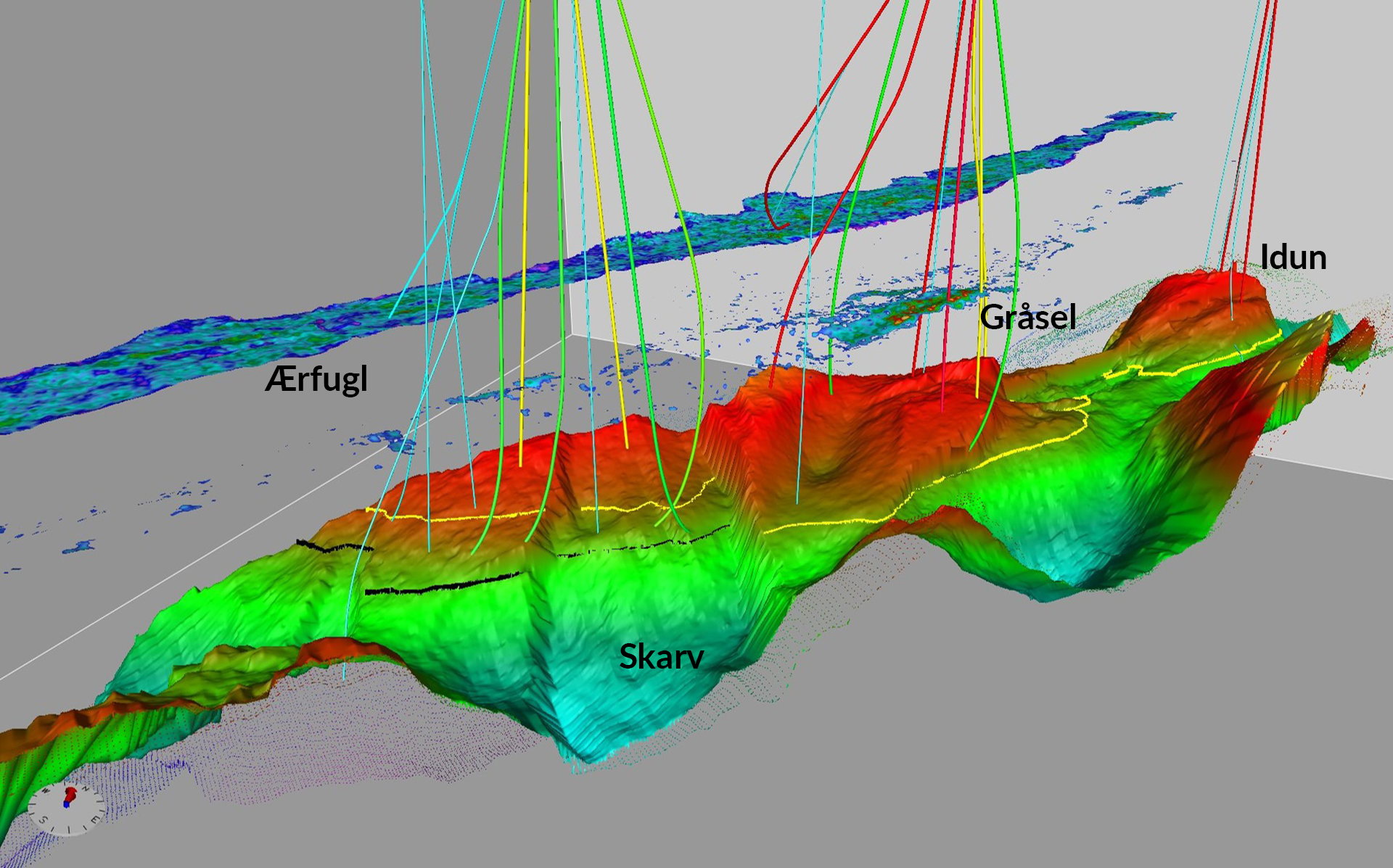

The Gråsel reservoir, which extends over seven kilometers and is two kilometers wide, is situated above the Skarv reservoir in the Norwegian Sea, approx. 210 kilometers west of Sandnessjøen.

Gråsel holds a total of around 13 million barrels of oil equivalent. The oil and gas production will utilize available capacity on the existing production vessel (FPSO) on the Skarv field. Total investment costs for the Gråsel project are around NOK 1.2 billion.

– Based on a development solution with reuse of existing infrastructure, this project has become very profitable. The break-even-price is around USD 15 per barrel, says Mette Nygård, project manager for Gråsel. The tax measures adopted by the Storting in June, which entails faster tax depreciation, has made the project even more robust and accelerated the development.

The development consists of a new producer drilled from an existing well slot on the Skarv field, and injection support from a joint injector for Gråsel and Tilje.

The successful early-phase work with Gråsel will be used as a model for future developments of smaller discoveries, which is one of Aker BP’s prioritized areas. Gråsel will also contribute to lifetime extension for the Skarv FPSO.

The first oil from Gråsel is planned for the fourth quarter of 2021, in the same period as Ærfugl phase 2 will come on stream.

– This will be the first time Aker BP links two projects to the same field center in the same year. This will be a milestone for the company. It also showcases how the excellent alliance collaboration with our suppliers contributes to safe and efficient project implementation, says Ine Dolve, SVP Operations and Asset Development at Aker BP.

PS: Gråsel = grey seal in English