Production

mboepd (2025)

Unit cost

$/boe (2025)

Dividend

$/share (2026)

Financial key figures

| Key figures | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 | Unit |

|---|---|---|---|---|---|---|---|---|---|

| Production volume | 448.0 | 444.1 | 414.7 | 449.2 | 441.4 | 415.0 | 414.0 | 410.6 | mboepd |

| Net sold volume | 428.9 | 460.9 | 391.3 | 439.2 | 457.6 | 413.8 | 396.1 | 431.4 | mboepd |

| Avg. realised price | 78.2 | 79.7 | 78.4 | 74.9 | 76.5 | 67.3 | 69.4 | 62.7 | USD/boe |

| Production cost | 6.1 | 6.4 | 6.6 | 5.7 | 6.5 | 7.3 | 7.6 | 7.9 | USD/boe |

| Total income | 3,078 | 3,377 | 2,858 | 3,068 | 3,201 | 2,584 | 2,599 | 2,560 | USD mill |

| EBITDA | 2,787 | 2,966 | 2,612 | 2,718 | 2,801 | 2,223 | 2,262 | 2,069 | USD mill |

| Net profit/loss | 531 | 561 | 173 | 562 | 316 | (324) | 286 | (145) | USD mill |

| Earnings per share | 0.84 | 0.89 | 0.27 | 0.89 | 0.50 | (0.51) | 0.45 | (0.23) | USD |

| Dividend per share | 0.60 | 0.60 | 0.60 | 0.60 | 0.63 | 0.63 | 0.63 | 0.63 | USD |

| Net interest-bearing debt | 3,284 | 4,104 | 3,286 | 4,026 | 3,946 | 5,663 | 6,071 | 7,094 | USD mill |

ESG data

| Key HSSE indicators | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 | Unit |

|---|---|---|---|---|---|---|---|---|---|

| Total recordable injury frequency (TRIF) L12M | 2.5 | 1.6 | 2.0 | 1.8 | 1.9 | 2.3 | 1.7 | 2.0 | Per mill. exp. hours |

| Serious incident frequency (SIF) L12M | 0.5 | 0.6 | 0.7 | 0.4 | 0.2 | 0.1 | 0.2 | 0.3 | Per mill. exp. hours |

| Acute spill | 0 | 0 | 0 | 1 | 1 | 0 | 1 | 0 | Count |

| Process safety events Tier 1 and 2 | 2 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | Count |

| GHG emissions intensity, equity share | 3.0 | 2.6 | 2.4 | 2.5 | 2.8 | 2.8 | 2.9 | 2.7 | Kg CO2e/boe |

Production

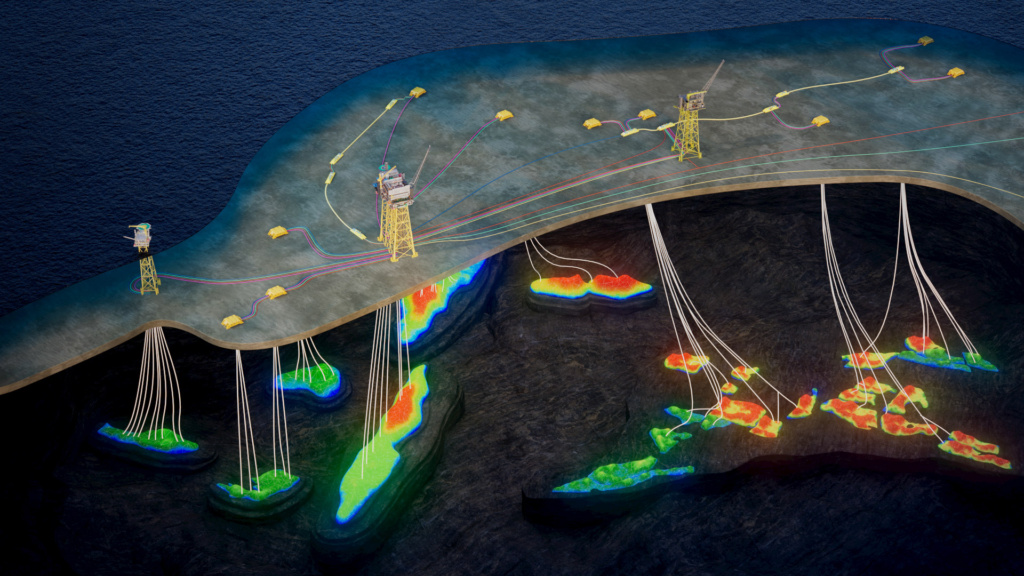

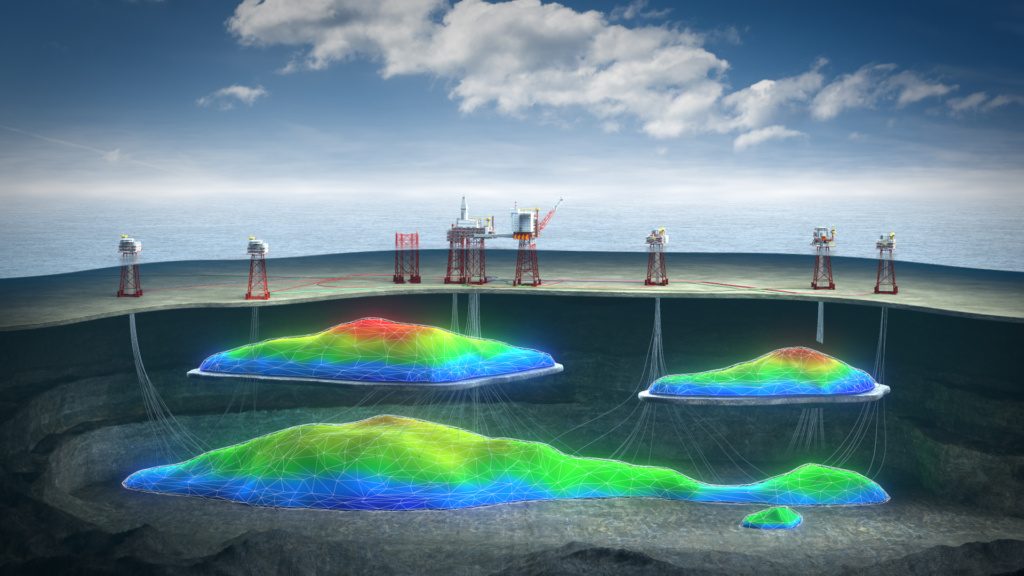

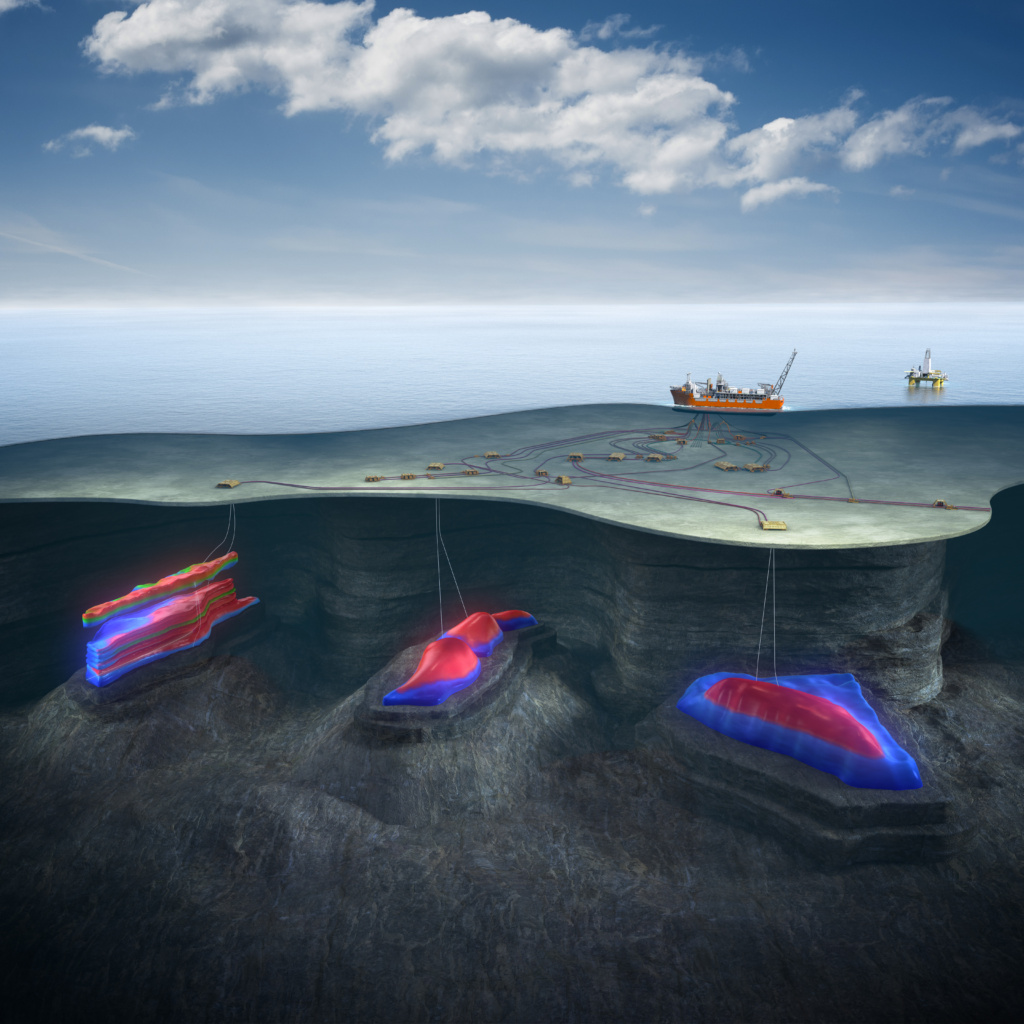

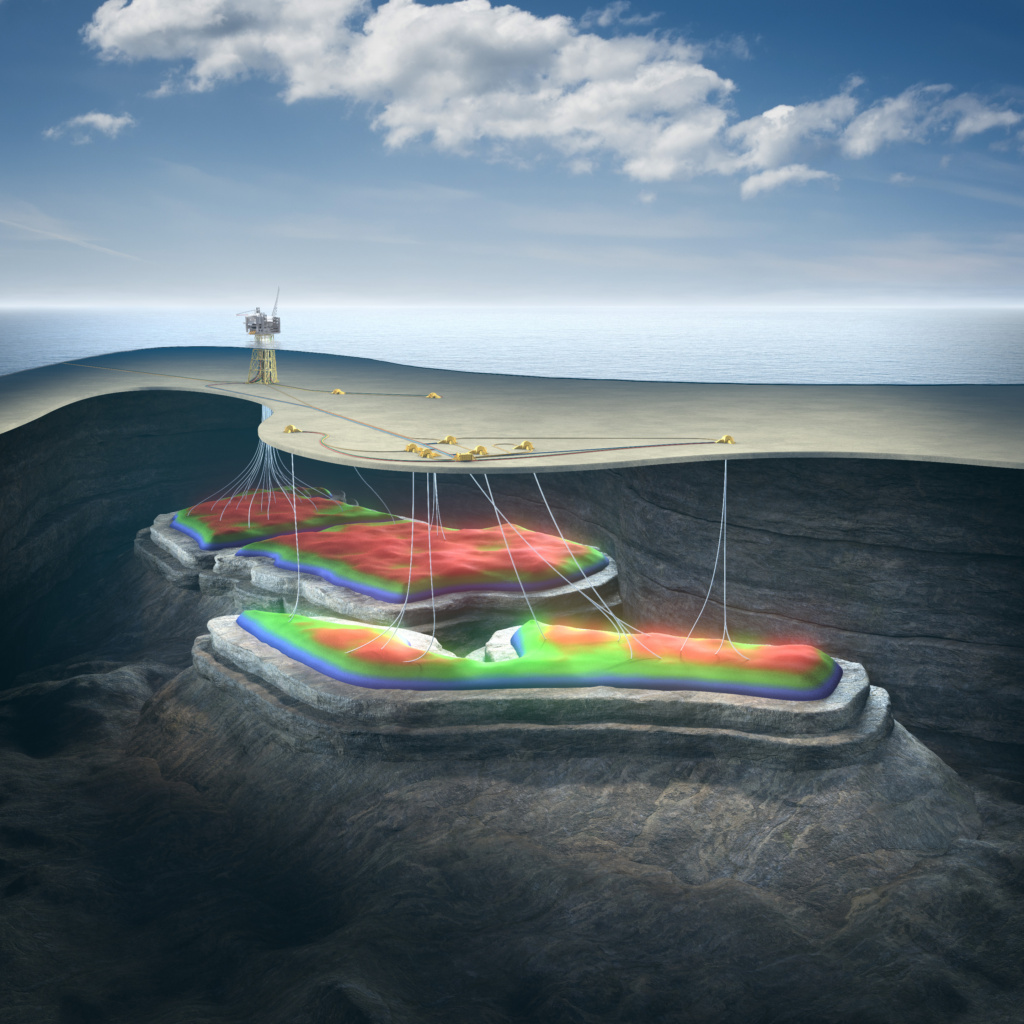

Aker BP is a leading oil and gas producer on the Norwegian Continental Shelf. The company operates the field centres at Alvheim, Eiga (Edvard Grieg and Ivar Aasen), Skarv, Valhall and Ula, and is a partner in the Johan Sverdrup field.

Aker BP’s oil and gas production

Producing assets

Reserves and resources

Aker BP’s reserve and contingent resource volumes are classified in accordance with the Society of Petroleum Engineer’s (SPE’s) Petroleum Resources Management System, and reported in accordance with Oslo Børs’ Listing and disclosure requirements for oil and natural gas companies.

Aker BP’s reserves and resources

| mmboe | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | 2024 |

|---|---|---|---|---|---|---|---|---|---|

| 2P reserves | |||||||||

| Reserves start of year | 498 | 711 | 914 | 917 | 906 | 842 | 802 | 1,859 | 1,716 |

| Production | (28) | (58) | (58) | (57) | (77) | (76) | (112) | (167) | (160) |

| Net additions/revisions | 241 | 261 | 61 | 46 | 13 | 36 | 1,169 | 24 | 12 |

| Reserves end of year | 711 | 914 | 917 | 906 | 842 | 802 | 1,859 | 1,716 | 1,568 |

| . | |||||||||

| Key ratios | |||||||||

| Reserve life1) | 25 | 16 | 16 | 16 | 11 | 11 | 17 | 10 | 10 |

| Reserve replacement ratio2) | 861% | 450% | 105% | 81% | 17% | 47% | 1044% | 14% | 8% |

| . | |||||||||

| 2C resources | |||||||||

| Resources end of year | 600 | 785 | 946 | 931 | 895 | 1,022 | 744 | 804 | 802 |

2) Net additions/revisions / Production (including acquisitions)

Projects

Aker BP has been building a significant portfolio of discoveries over many years. In 2022, the company and its partners took the final investment decisions for projects aiming to develop approximately 700 mmboe of new oil and gas resources net to Aker BP.

Overview of Aker BP’s field development projects

Exploration

Planned exploration wells

| Prospect | Licence | Operator | Aker BP share | Pre-drill mmboe | Est. timing |

|---|---|---|---|---|---|

| Carmen (appraisal) | 1148 | Wellesley | 10% | 2026-Q1 | |

| Tonjer | JSU | Equinor | 32% | 10-20 | 2026-Q1 |

| Alpehumle | 1153 | Aker BP | 40% | 10-190 | 2026-Q2 |

| Svarteknippa | 979 | Aker BP | 60% | 10-60 | 2026-Q2 |

| Linga | 782S | Equinor | 40% | 10-50 | 2026-Q2 |

| MG | 1042 | Equinor | 40% | 10-110 | 2026-Q3 |

| Schrøder | 1177 | Equinor | 15% | 25-110 | 2026-Q3 |

| Symra Ph2 (appraisal) | 167 | Aker BP | 50% | 2026-Q3 | |

| Lindesnes East | 1102 | Equinor | 20% | 15-50 | 2026-Q3 |

| Norma appr. | 984 | DNO | 10% | 2026-Q3 | |

| Freke North | 1139 | Aker BP | 70% | 25-90 | 2026-Q4 |

| Anabelle | 929 | Vår Energi | 10% | 15-75 | 2026-Q4 |

| Arkenstone | 1014 | Equinor | 10% | 65-300 | 2027 |

Exploration wells completed in 2025

| Prospect | Licence | Operator | Aker BP share | Result | SODIR announcement |

|---|---|---|---|---|---|

| Elgol | 1131 | Vår E. | 20% | 3-19 mmboe | 2025-Q1 |

| Rumpetroll South | 869 | Aker BP | 80% | Dry | 2025-Q1 |

| Njargasas | 1110 | Aker BP | 55% | Dry | 2025-Q1 |

| Kokopelli | 1090 | Vår E. | 20% | Dry | 2025-Q1 |

| Horatio | 1109 | OMV | 20% | Dry | 2025-Q1 |

| Kjøttkake | 1182S | DNO/Aker BP | 45% | 39-75 mmboe | 2025-Q1 |

| Bounty | 886 | Aker BP | 60% | Dry | 2025-Q1 |

| Kongeørn | 942 | Aker BP | 30% | Dry | 2025-Q1 |

| E-Prospect | 212 | Aker BP | 30% | 3-7 mmboe | 2025-Q2 |

| Rondeslottet | 1005 | Aker BP | 40% | Dry | 2025-Q2 |

| Skrustikke | 554 | Equinor | 30% | Dry | 2025-Q3 |

| Omega Alfa | 873/873B/ 1249 | Aker BP | 48%/ 38% | 96-134 mmboe | 2025-Q3 |

| Narvi | 554E | Equinor | 30% | Dry | 2025-09-19 |

| Natrudstilen | 873 | Aker BP | 48% | Dry | 2025-11-07 |

| Avbitertang | 554 | Equinor | 30% | Dry | 2025-11-11 |

| Page | 1086 | DNO | 20% | Dry | 2025-11-18 |

| Lofn & Langemann | 1140 | Equinor | 40% | 30-110 mmboe | 2025-12-05 |

Exploration wells completed in 2024

| Prospect | Licence | Operator | Aker BP share | Result | SODIR announcement |

|---|---|---|---|---|---|

| Trell North | 102G | Aker BP | 61% | 3-8 mmboe | n.a. |

| Ametyst | 1138 | Harbour | 30% | 6-19 mmboe | 2024-Q1 |

| Adriana (appraisal) | 211CS | WinDea | 15% | 23-45 mmboe | 2024-Q1 |

| Ypsilon | 442 | Aker BP | 88% | Dry | n.a. |

| Ringhorne North | 956 | Vår E. | 20% | 13-23 mmboe | 2024-Q2 |

| Alvheim Deep | 203 | Aker BP | 80% | Dry | 2024-Q2 |

| Ferdinand | 1170 | Aker BP | 35% | 3-5 mmboe | 2024-Q2 |

| Hassel | 1170 | Aker BP | 35% | 3-4 mmboe | 2024-Q2 |

| Storjo | 261 | Aker BP | 70% | 21-67 mmboe | 2024-Q4 |

| Kvernbit | 1185 | Equinor | 20% | Dry | 2024-Q4 |

| Othello/Falstaff | 1086 | DNO | 20% | 25-57 mmboe | 2024-Q4 |

| Sabina (appraisal) | 211CS | WinDea | 15% | 17-39 mmboe | 2024-Q4 |

| Kaldafjell | 932 | Aker BP | 40% | Dry | 2024-Q4 |

Mergers & Acquisitions

M&A is an integrated part of Aker BP’s strategy, and the company has undertaken several transforming transactions through the years. The most significant of these transactions are described below.

- Aker BP acquired Lundin Energy’s oil and gas business, including significant interests in the Johan Sverdrup, Edvard Grieg and Alvheim fields, with 2P reserves per end-2021 totaling 639 mmboe.

Original press release >> - As consideration, the Lundin shareholders received 0.95098 Aker BP shares and USD 7.76 in cash for each share held in Lundin Energy. In total, Aker BP issued 271.9 million new shares, and the cash consideration amounted to USD 2.22 billion.

- The transaction was completed on 30 June 2022.

- Aker BP acquired Equinor’s 77.8 percent interest in the King Lear gas/condensate discovery in the Norwegian North Sea for a cash consideration of USD 250 million.

Original press release >> - Net recoverable resources were estimated to more than 100 mmboe. The original plan was to develop King Lear as a satellite to Ula.

- The discovery has since been renamed to Fenris, and is currently being developed as a satellite to Valhall.

- Aker BP acquired Total E&P Norge’s interests in a portfolio of 11 licences on the Norwegian Continental Shelf for a cash consideration of USD 205 million. The portfolio included four discoveries with net recoverable resources of 83 mmboe.

Original press release >> - The portfolio included the Trell and Trine discoveries (now renamed to Tyrving) near the Alvheim field, the Alve Nord discovery north of the Skarv field, and the Rind discovery in the Yggdrasil area. All these discoveries are currently under development.

- Aker BP acquired Hess Norge AS and became the sole owner of the Valhall and Hod fields, adding 150 mmboe in 2P reserves, and a tax loss carry forward valued at USD 1.5 billion, for a cash consideration of USD 2 billion.

Original press release >> - The company raised USD 500 million in new equity to fund the transaction. Aker ASA and BP plc. participated with 40 and 30 percent respectively.

- Subsequently, Aker BP sold 10 percent of Valhall and Hod to Pandion Energy.

- Det norske oljeselskap ASA entered into an agreement to merge with BP Norge AS through a share purchase transaction, with the Aker BP ASA as the new company name. With this, the company became the operator of Skarv, Ula and Valhall, with 2P reserves of 225 mmboe.

Original press release >> - The transaction was financed by issuing 135.1 million new shares, and was effective from October 2016.

- After the transaction, Aker ASA and BP plc. held 40 and 30 percent of the share capital in Aker BP, respectively.

- Det norske oljeselskap ASA acquired Marathon Oil Norge AS and became the operator and largest owner of the Alvheim area with 136 mmboe in 2P reserves for a cash consideration was USD 2.1 billion.

Original press release >> - The transaction was financed with bank facilities and USD 500 million in new equity, and was completed in October 2014.